Dr M Pattabiraman (PhD), aka Pattabiraman Murari, aka pattu, is the founder, managing editor and primary author of freefincal. He is an associate professor at IIT, Madras and the author of three personal finance books with over eleven years of experience publishing news, analysis, research, and financial product development. Several of his calculators have been published on the investor awareness website of SEBI.

Passionate about teaching, he was awarded the “Young Faculty Recognition Award” by IIT Madras in 2012. He has conducted money management sessions at the Quora World Meetup and for employees of the World Bank, RBI, Nuclear Power Corporation of India Limited, BHEL, Asian Paints, PayPal, RBS India, Societe General, Honeywell and many other institutions.

Expertise and Experience

Dr Pattabiraman’s expertise includes mutual fund analysis, investment risk, retirement planning, stock valuation and personal finance.

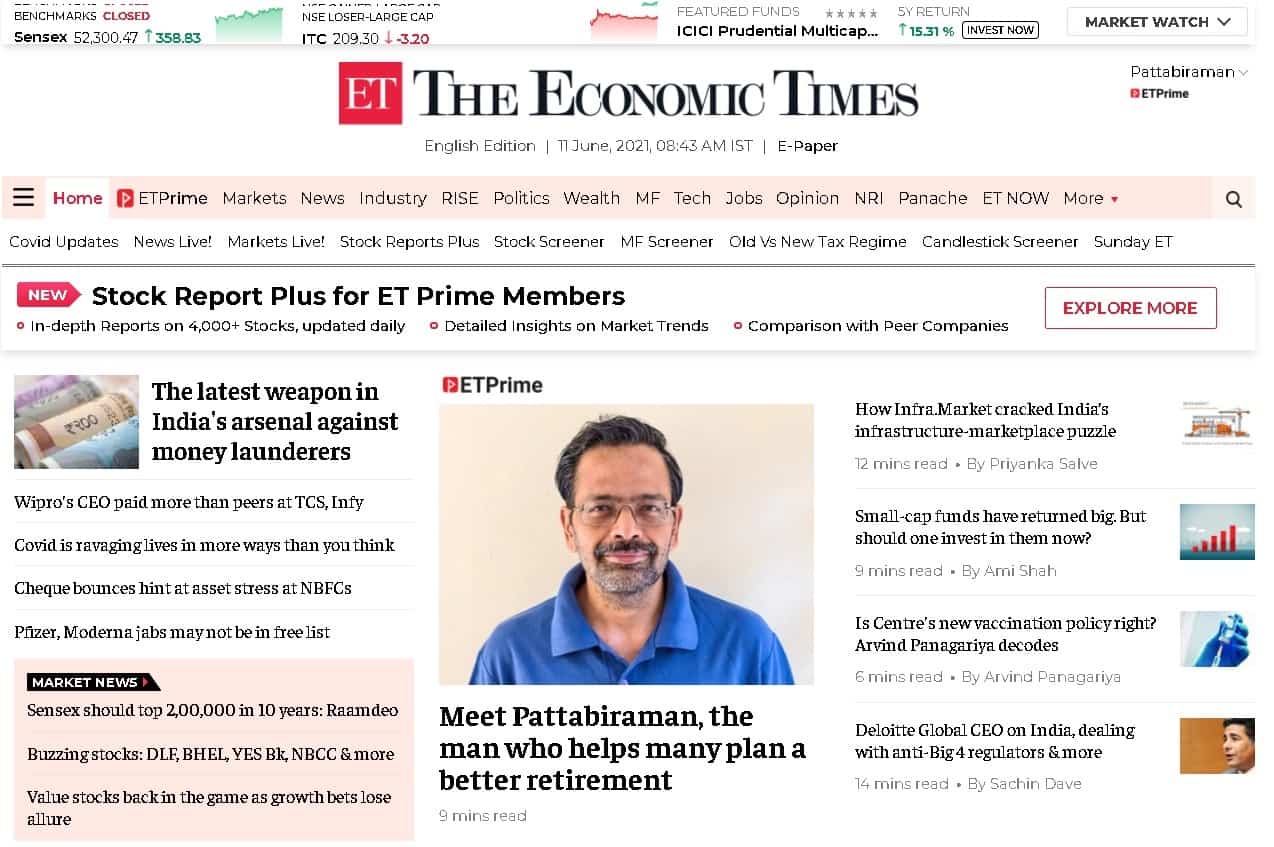

He has been profiled in the Economic Times: Meet Pattabiraman, the man who helps many plan a better retirement through his calculators.

His journey to financial independence has been featured on LiveMint: Light the FIRE and lose the fear of getting fired. And Can your FIRE dreams get past the COVID-19 impact?

Pattabiraman specialises in financial goal-based portfolio management where the investment risk is gauged based on need alone, regardless of market movements. This has resulted in a unique open-source robo-advisory tool.

His analytical tools and research on mutual fund investing, stock selection, pre-retirement planning, post-retirement risk management, and portfolio management have been published regularly at freefincal since May 2012. The site serves over three million readers annually (5 million plus page views).

Work with SEBI

The SEBI Investor Protection Education Fund Advisory Committee recommended nine of his calculators be part of the SEBI Investor Education Website. Further details can be found in the announcement post.

A financial health check tool created by Pattabiraman is now part of the revamped SEBI Investor Education website.

Also, see Outlook Money article: Sebi Shares Calculator By IIT-M Professor That Allows Changing Asset Allocation Over Investment Tenure.

Sebi Incorporates Financial Health-Check Tool On Its Investor Education Portal.

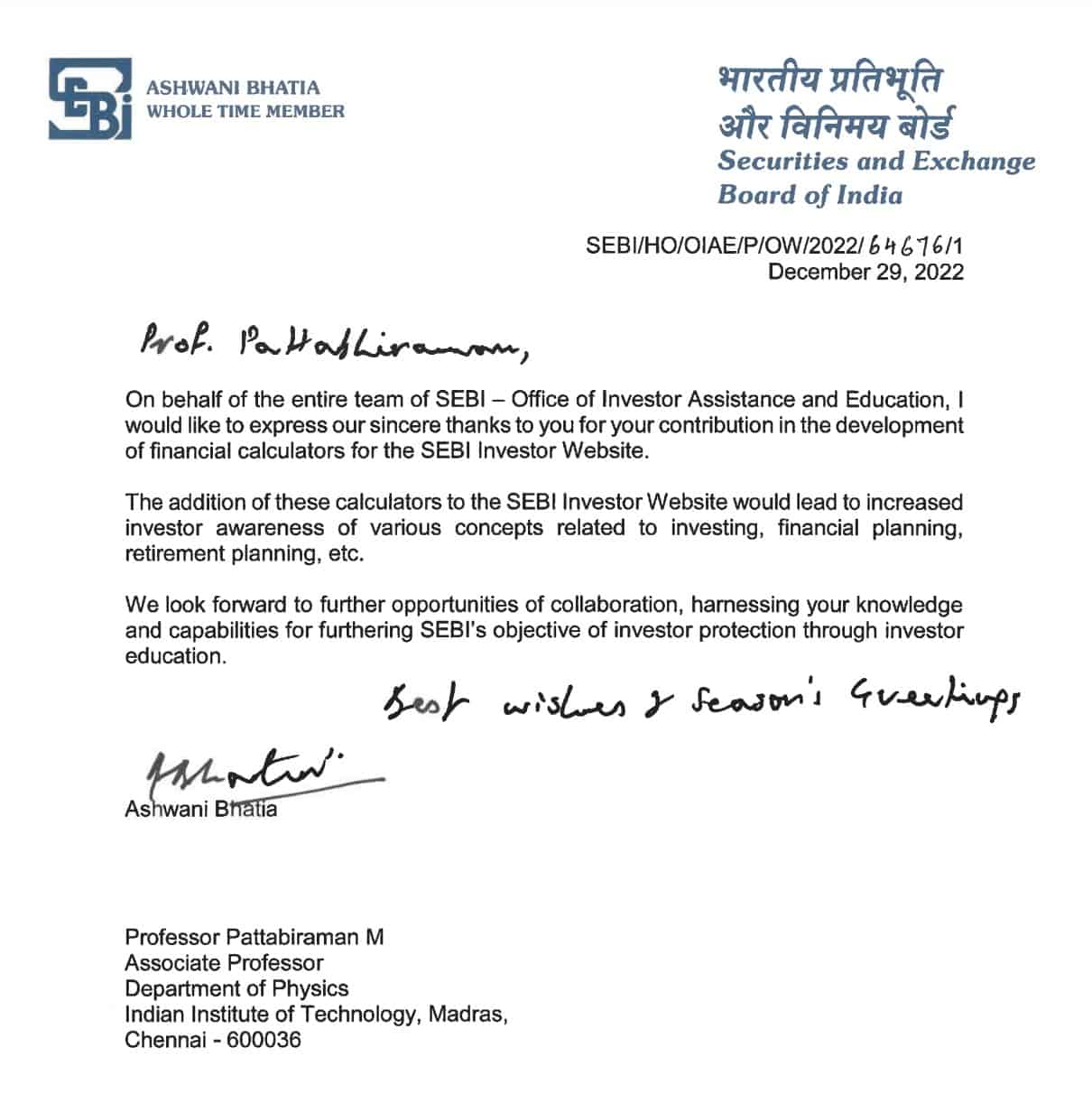

Letter of appreciation from SEBI.

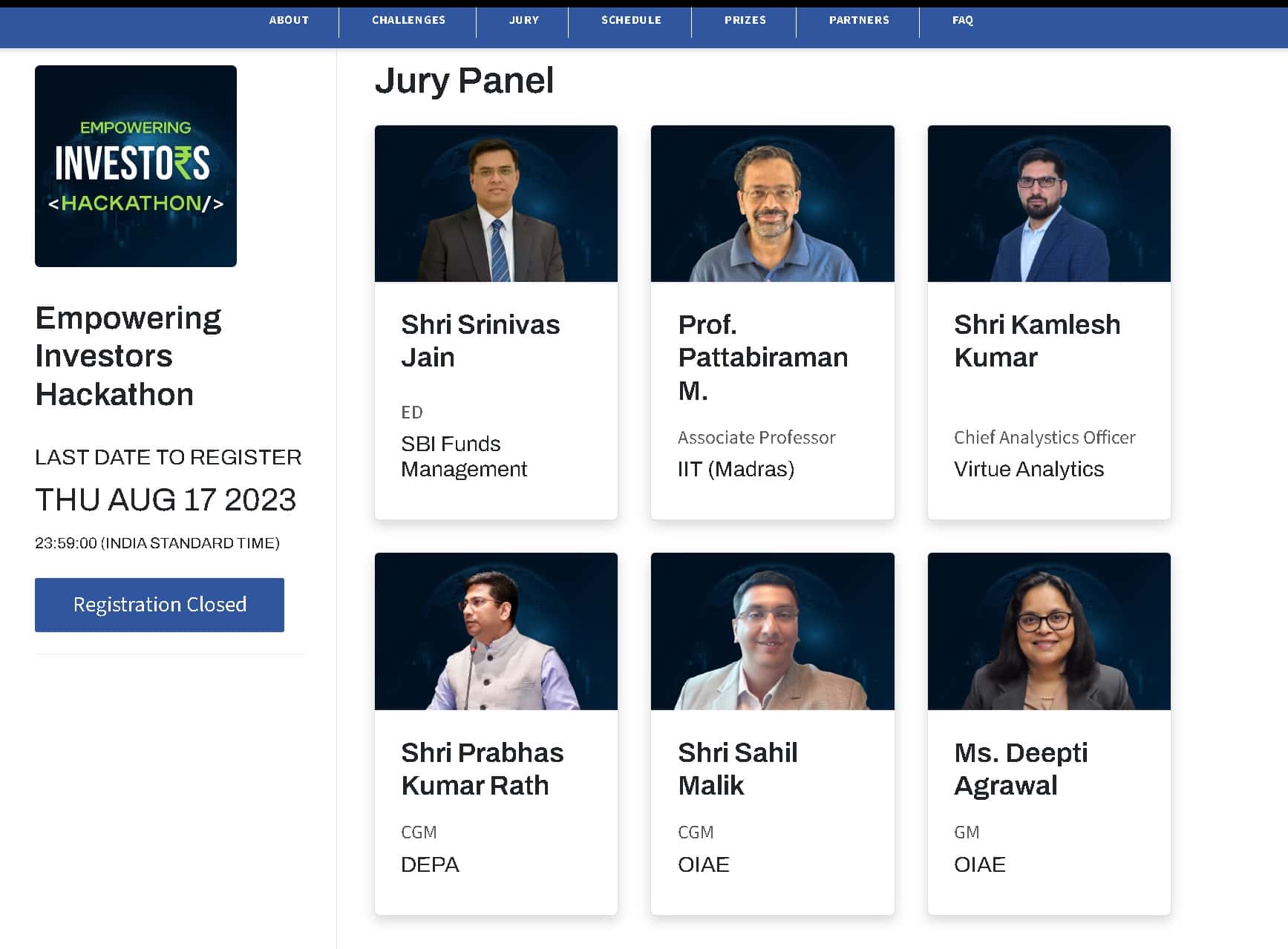

Dr. Pattabiraman was a Jury Member of the SEBI Empowering Investors Hackathon.

Books by M Pattabiraman

Popularly known as “Pattu”, Dr M. Pattabiraman has written three books:

Chichu Gets a Superpower! – teach your kids how to manage money responsibly.

You Can Be Rich Too With Goal-based Investing (CNBC TV18)

- You Can Be Rich Too With Goal-based Investing at Google Play

- You Can Be Rich Too With Goal-based Investing at Amazon

Gamechanger: Forget Start-ups, Join Corporate and Still Live the Rich Life you want

And seven other free e-books on various topics of money management.

Interviews

Watch his interview with Mandeep of Labour Law Advisors

Also see: Jagruk Talks with Dr Pattabiraman: How to plan for retirement

Interview in Tamil with Venkatesh Anbumani for Vam Vodcast

Also, see Exploring the Depths of Finance Wisdom with M Pattabiraman

Interview for The Fifth Estate (official student media body of IIT Madras): A Passion for Teaching

Pattabiraman’s interview also appears in The Wisest Owl: Be your own financial planner by Anupam Gupta.

Podcasts

Let’s get rich with Pattu, produced by Ofspin is a weekly podcast on money management. Each episode will cover one aspect of money management – insurance, emergency funds, planning for retirement, financial independence and early retirement, buying vs renting and more.

Ways to listen:

- Let’s get rich with Pattu on Audible

- Let’s get rich with Pattu on Google Podcasts

- Let’s get rich with Pattu on Spotify

- Let’s get rich with Pattu on Apple Podcasts

- Let’s get rich with Pattu on Amazon Music

- Let’s get rich with Pattu on JioSaavn

- Let’s get rich with Pattu on Gaana

- Let’s get rich with Pattu on iHeart

- Let’s get rich with Pattu on Deezer

Times of Indian Podcast on changes to the New Tax Regime proposed in Budget 2023

Paisa Vaisa Podcast with Anupam Gupta

- Ep. 137: Financial Freedom Part 1

- Ep. 138 What is financial freedom?

- Ep. 139: Financial Freedom Part 2

- Ep. 140: Planning for financial freedom

- Ep 141: Financial Freedom Part 3

- Ep 142: Executing a financial freedom plan

Portfolio and experience

His portfolio details and experience can be found here:

- Fourteen Years of Mutual Fund Investing: My Journey and lessons learned

- Lessons from investing for my son’s future for the last 12+ years

- Stock Portfolio Analysis

Youtube Channel

The freefincal YouTube channel has over 1000 videos on personal finance and DIY investing. Regular viewers are accustomed to Pattu’s opening lines and callsign, “Hi, I am pattu from freefincal”!

Guest Articles

He is also a contributor to The Economic Times

- Why investing is not only about equity

- Mutual fund advisers earning commissions from AMCs may not give you the best advice.

- DIY investing is not everybody’s cup of tea

News Article Quotes and Other Media Mentions

What to consider in opting for a higher pension from EPS

Keep your money safe: Stick to systemically important banks for safety

Non-linked insurance plan: Surrender or stay? Do the math before deciding

The better way out of a troubled fixed maturity plan for investors

7 common money myths that are still doing the rounds

ITR filing: Don’t make these mistakes to avoid getting tax notice

These young professionals have a new motto- to retire early

My business grew after SEBI came up with direct plans

Direct plans of equity MFs can help negate impact of LTCG tax

Forget direct plans, these ETFs charge only 0.05 per cent

Avoid mis-selling at banks, research before buying financial product

Article by SEBI RIA Avinash Luthria: The 8 most surprising stories in the Financial Planning profession in India

Full list: News Media Presence of M Pattabiraman and freefincal

Fee-only India

He is a patron and co-founder of “Fee-only India”, which promotes unbiased, commission-free investment advice.

Integrity and core principles

Pattabiraman focuses on reportage journalism and research. All freefincal articles are based only on factual information and detailed analysis by their authors. Credible and knowledgeable sources will verify all statements made before publication.

Pattabiraman does not provide individual investment advice and does not publish paid articles, promotions, PR, or satire. All opinions will be inferences backed by verifiable, reproducible evidence/data. He follows strict journalistic integrity defined by the freefincal’s Policies and Standards.

Corporate Sessions

He conducts free money management sessions for corporations and associations(see details below). Previous engagements include the RBI, BHEL, Nuclear Power Corporation of India Limited, Asian Paints, PayPal, RBS India, Societe General, Honeywell, Tamil Nadu Investors Association, Quora World Meetup etc.

Watch his talks

This talk was given to World Bank Employees in Feb 2019: Common sense approach to managing money.

Index investing options in India: This talk was given to members of the Tamil Nadu Investors Association

Getting Started Guide: Re-assemble

Re-assemble is a free step-by-step guide to help you manage money.

Download Re-assemble: Step-by-step money management basics for beginners

Related Links

- Pattabiraman is listed on the Indian Research Information Network System

- Vidwan (Expert Database and National Researcher Network) Profile of M Pattabiraman

- IIT Madras, dept of Physics listing.

- IIT Madras Publications page

- Reddit AMA conducted by M. Pattabiraman

- Google Scholar Page

- Google Knowledge Panel link

- Amazon Author Page

- Amazon India Author Page

- ORCID Page

- Scopus Profile

- Mendeley Profile

- Personal web page: mpattabiraman.com

Contact

- Follow Pattabiraman on Twitter

- Follow Pattabiraman on Facebook

- Connect with him on Linkedin

- Contact information: pattu {at} freefincal {dot} com (sponsored posts or paid collaborations will not be entertained)